what is suta tax texas

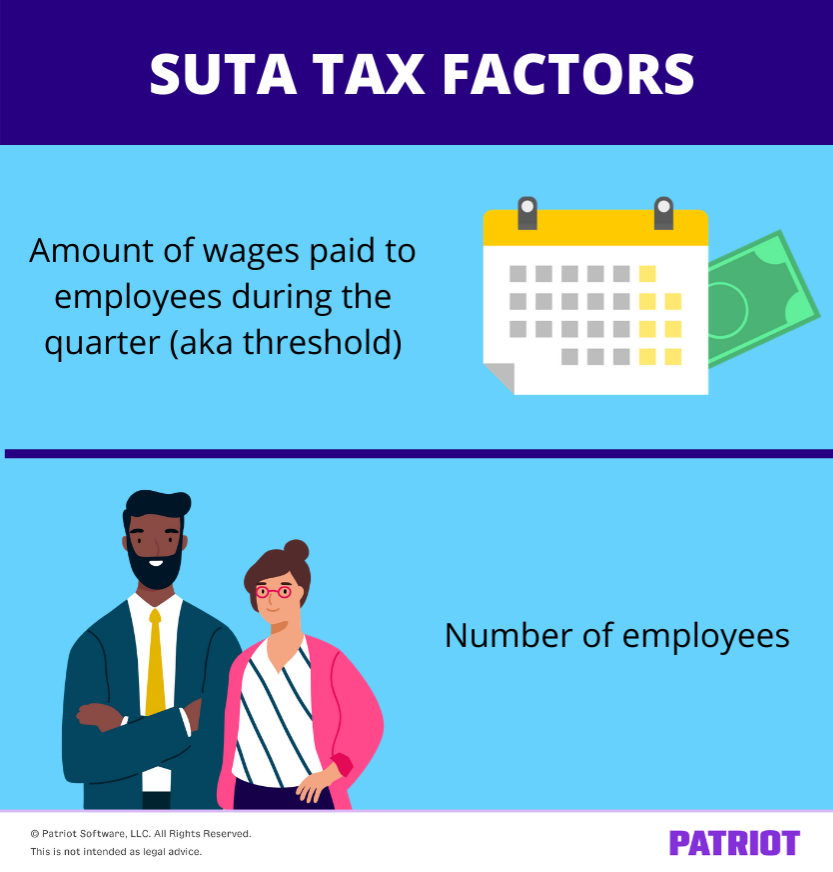

The FUTA tax rate is 6 and applies to the first 7000 paid to each employee as wages during the year. State unemployment tax assessment SUTA is based on a percentage of the taxable wages an employer pays.

Benefits May Be Available For Spouses Dependents With Employment Affected By Covid 19 Air Education And Training Command Article Display

Employers contribute to the state.

. Minimum Tax Rate for 2022 is 031 percent. What is SUTA. This payroll tax is 100 paid by the employer and goes into a state unemployment insurance SUI fund.

The State Unemployment Tax Act SUTA tax also called SUI state unemployment insurance or reemployment tax is a type of payroll tax that employers must pay to the state. FUTA is an abbreviation for F ederal U nemployment T ax A ct. Maximum Tax Rate for 2022 is 631 percent.

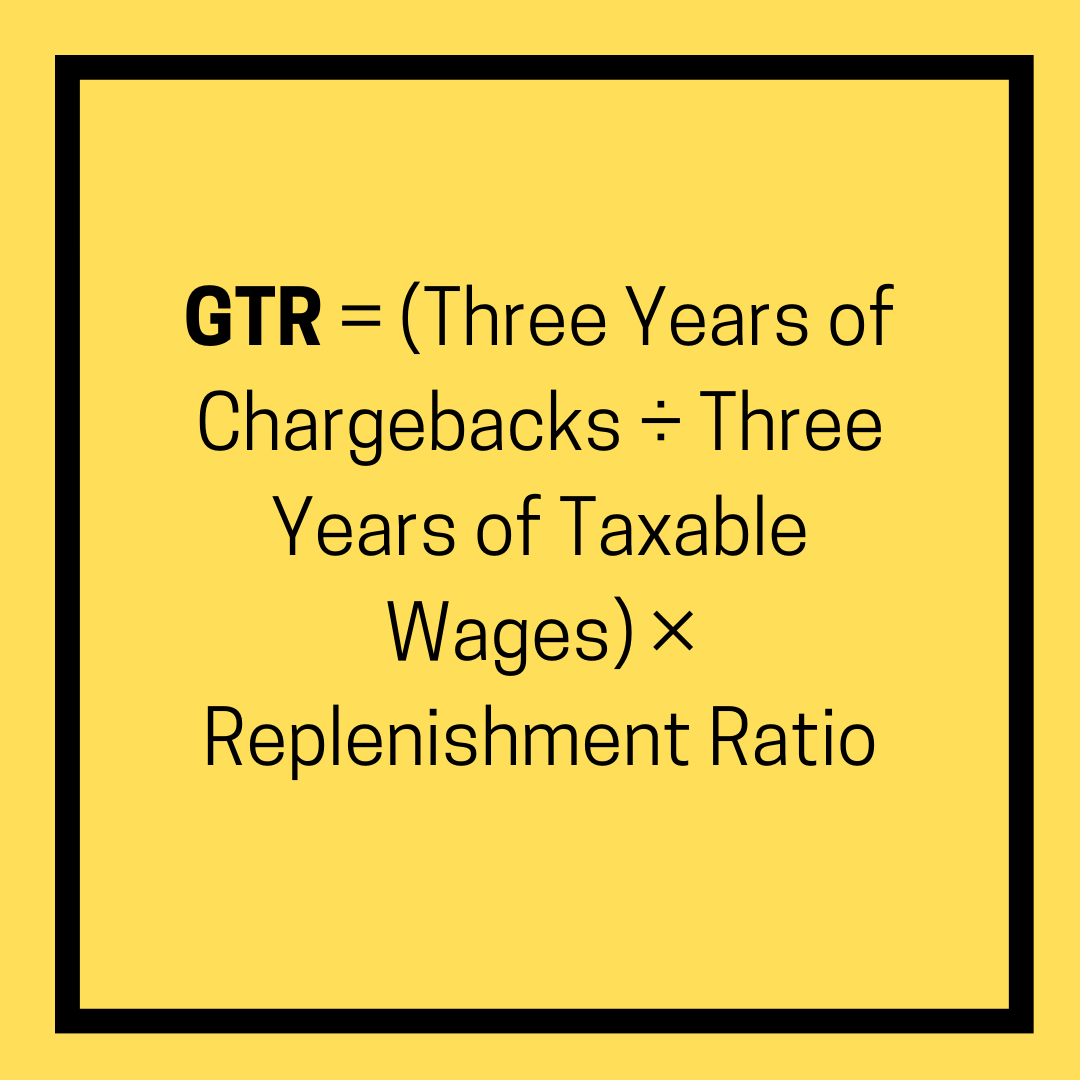

The Texas state unemployment tax rate is 825. How Is Unemployment Tax Rate Calculated. SUTA stands for State Unemployment Tax Act.

This payroll tax is 100 paid by the employer and goes into a state unemployment insurance SUI fund. What Is Texas State Unemployment Tax Rate. The State Unemployment Tax Act SUTA also known as State Unemployment Insurance SUI is a payroll tax required of employers.

Assume that your company receives a good assessment and your SUTA tax. Determine if a worker is an employee or independent contractor using our comparative approach. Tax rate Each state sets a range of minimum and maximum tax rates for SUTA taxes.

In 2019 the taxable wage base for employees in Texas is 9000 and the tax rates range from 36 to 636. The unemployment tax rate is calculated. In the case of the state unemployment tax this is a deduction made by employers.

52 rows SUTA the State Unemployment Tax Act is the state unemployment insurance program to benefit workers who lost their jobs. Texas defines wages for state unemployment insurance SUI purposes as all compensation paid for personal services including the cash value of all compensation paid in any medium other. FUTA is federally managed and states regulate SUTA.

According to the IRS if. Once paid these taxes are placed into. Understand tax rate calculations.

Some states apply various formulas to determine the taxable wage base. Generally states have a range of. Most states send employers a new SUTA tax rate each year.

FUTA Tax is a United States federal tax imposed on employers to help fund unemployment payments. The SUTA tax is a type of payroll tax deducted from paychecks and remitted to the government. The federal government applies a standard 6 FUTA tax rate across industries and it does not change based on how.

Staying with the Texas example the minmax tax rate for 2020 ranged from 031 to 631. You pay unemployment tax on the first 9000 that each employee earns during the. Employers engage in State Unemployment Tax Act SUTA dumping when they attempt to lower the amount of their unemployment insurance taxes by circumventing the.

Understand State Unemployment Tax. You may receive an updated SUTA tax rate within one year or a few years. The 7000 is often referred to as the federal or FUTA wage base.

SUTA stands for State Unemployment Tax Act. Each state establishes its.

Payroll Software Solution For Texas Small Business

Texas Workforce Commission Answers Questions About Unemployment Benefits Texas Hotel And Lodging

Unemployment Insurance Tax Codes Tax Foundation

Suta Tax Requirements For Employers State By State Guide

3 11 154 Unemployment Tax Returns Internal Revenue Service

Suta Tax Your Questions Answered Bench Accounting

Texas Workforce Commission Lowers Employer Tax Rates For 2020 Corridor News

The Complete Guide To Texas Payroll Taxes 2022

A Complete Guide To Texas Payroll Taxes

Texas Workforce Commission Launches New Process For Handling Unemployment Claims Khou Com

Texas Lowers 2019 Unemployment Insurance Tax Rate 501 C Agencies Trust

Texas Payroll Tax And Registration Guide Peo Guide

What Is The Suta Tax And Why Is It Going Up In 2021 Fourth

Irs Extends Tax Deadlines For Texas Residents And Businesses Mc Gazette

Texas Workforce Commission On Twitter Understandingunemployment Question When Will I Get My 1099 G Unemployment Tax Form Answer We Will Be Sending Out 1099 G Tax Forms Out Through The Remainder Of January Learn

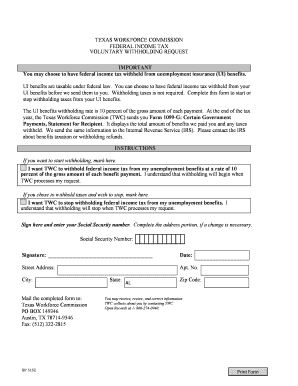

Texas Unemployment Benefits Application Form Fill Online Printable Fillable Blank Pdffiller